For example, your business sells bills to a factoring firm.Ī/R factoring and traditional operating lines of credit are both types of post-receivable financing, implying that an invoice has been created.Ī traditional operating line of credit is a flexible loan from a financial institution that consists of a fixed amount of money you can borrow when you need it and return either instantly or over time. Receivables factoring deals are often structured as a sale of your invoices instead of a loan.

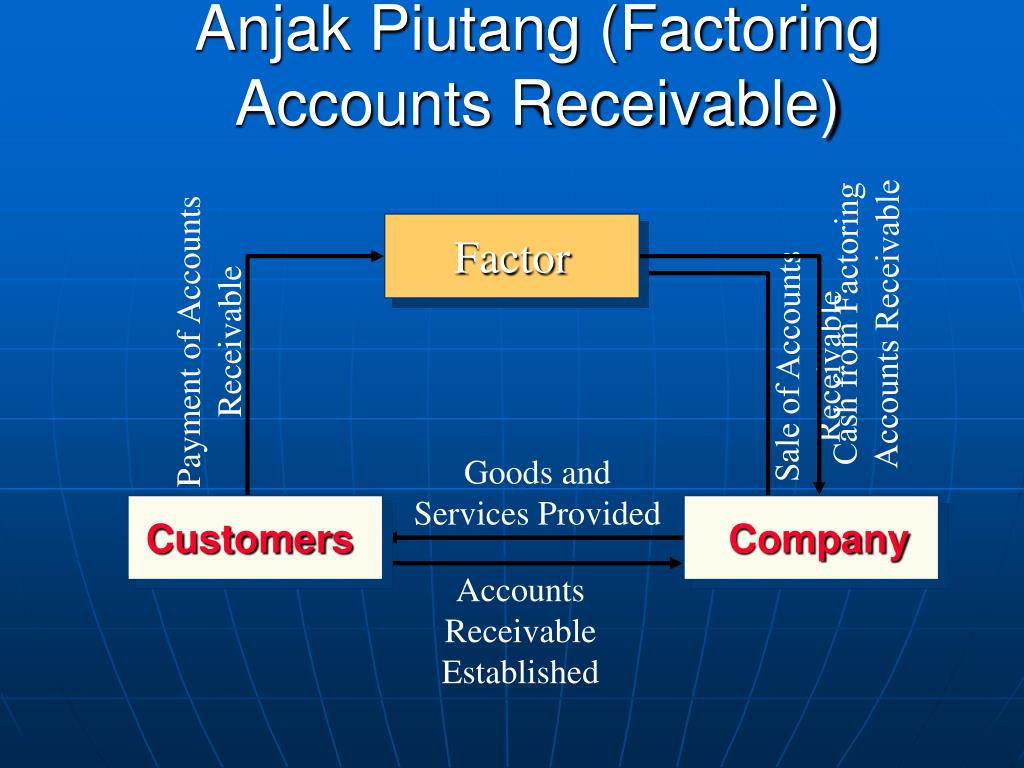

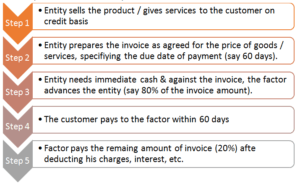

Traditional operating line of creditĪccounts receivable factoring is a sort of commercial borrowing that assists businesses with cash flow problems. The key here is that you receive the majority of the money owing to you relatively immediately, ensuring that you can handle the cost of operating your business while still having the cash you need to develop. Consider the following benefits and drawbacks of factoring receivables. However, this strategy has restrictions and drawbacks like any other financing option. The transaction is completed once the client pays the invoice, which normally takes between 30 and 90 days.įactoring can help your business develop quickly and service more customers. The factoring business pays you immediately, with the invoice as security. You submit an invoice to your client after you have delivered a product or service to them. The benefit of factoring is that the manufacturer handles the default risk instead of the enterprise. In addition, the company can utilize the money for commercial purposes now that it has it.Īs a result of the component, the restricted cash flow owing to credit consumers is freed. This allows the company to get the payment immediately instead of waiting until the due date. In turn, the factor collects payments on account of receivables from the clients on the due dates specified in the sale transaction. The factor funds the corporation after the entity has sold the items on credit to a consumer. This procedure can be performed as many times as necessary. In exchange, the factoring business will pay you immediately after the purchase. Receivables factoring deals are often structured as a sale of your invoices instead of a loan, and the business sells bills to a factoring firm. Typically, the company will collect payments on behalf of the corporation.

This anticipated future payment is shown on the vendor's financial statements as an account receivable.įactoring receivables is a method of releasing cash flow that unpaid bills have held up. For example, a borrower sells a product and generates an invoice for payment at a future date.

As a result, small businesses with a steady client base can frequently qualify.įactoring is only accessible as a financing method for businesses that sell on credit terms. The approval procedure is mostly based on the credit quality of your invoices rather than your company's financial condition. It's especially well-suited for companies with lengthy net terms but continuing operational costs or fresh expenses that assist in accelerating expansion.įactoring assists small and developing firms that are unable to obtain traditional finance. Small and developing businesses that do not have big financial reserves frequently employ A/R factoring.Īccounts receivable finance allows company owners to advance on such bills and utilize the cash for critical business requirements instead of waiting weeks or months for customers to pay their invoices. It enables businesses to finance their accounts receivable, providing instant money. It is also called invoice factoring or debtor financing. It is asset-based financing in which the company sells its right to collect payment from receivables to a third party at a discount to acquire money immediately from the driver. It can also be mentioned as A/R factoring or invoice factoring. Accounts receivable factoring is a sort of commercial borrowing that assists businesses with cash flow problems.

0 kommentar(er)

0 kommentar(er)